Smooth Sailing For Freelancer payments

Cavalry Payroll has your back

Cavalry Payroll helps liberate companies from the burden and administrative overhead tied to engaging and paying freelancers directly. Navigate the freelancer landscape effortlessly, leaving all those headaches behind you!

Embrace A Smoother, Stress-Free Freelancer Engagement Experience

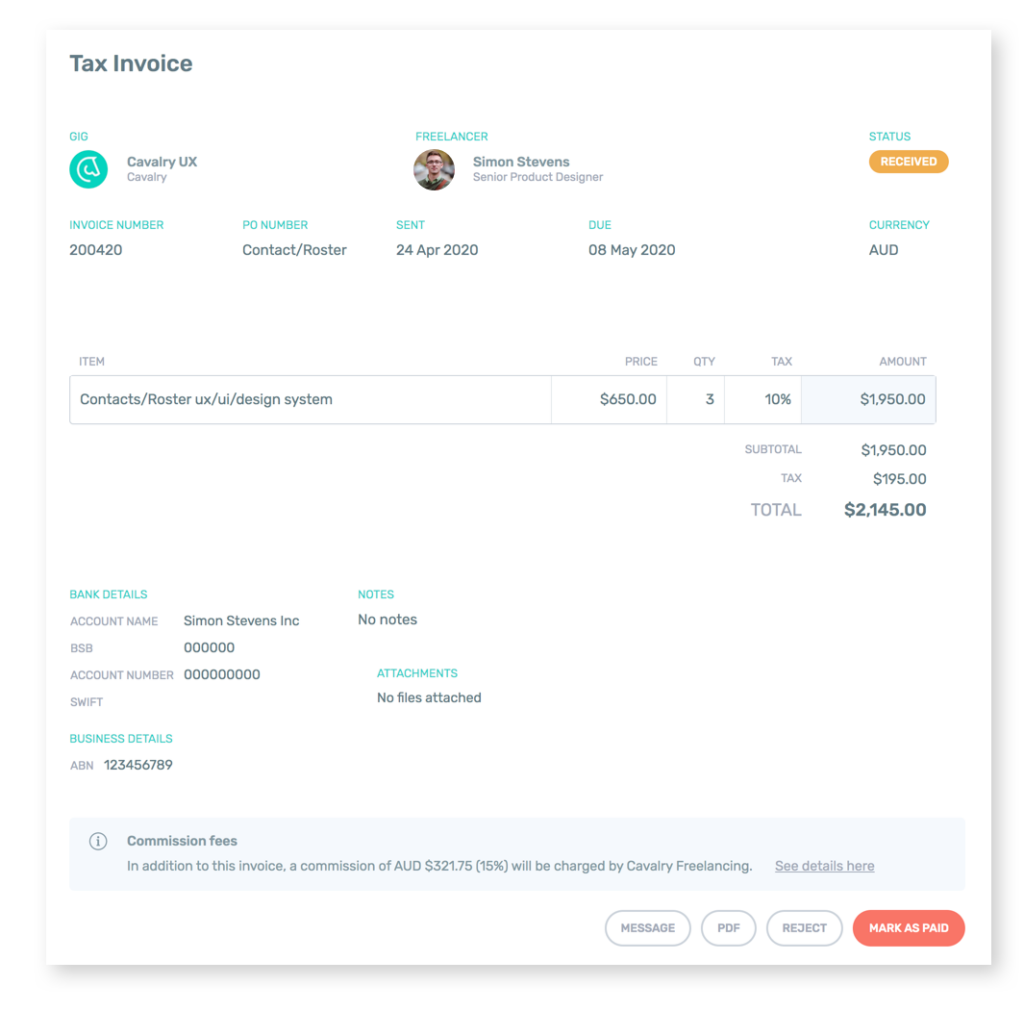

Freelancer engagement, onboarding and payroll – we’ve got you! Our system simplifies the invoicing process , whatever your freelancer count. Timely payment = happy freelancers, and with Cavalry Payroll, paying freelancers is a breeze!

Cashflow Just Got

A Whole Lot Easier

Our payroll fees are top-notch, and we keep things flexible. You handle your payments every 30 days, and we make sure freelancers are paid within the same terms. Simple as that with Cavalry – because keeping things straightforward is our jam.

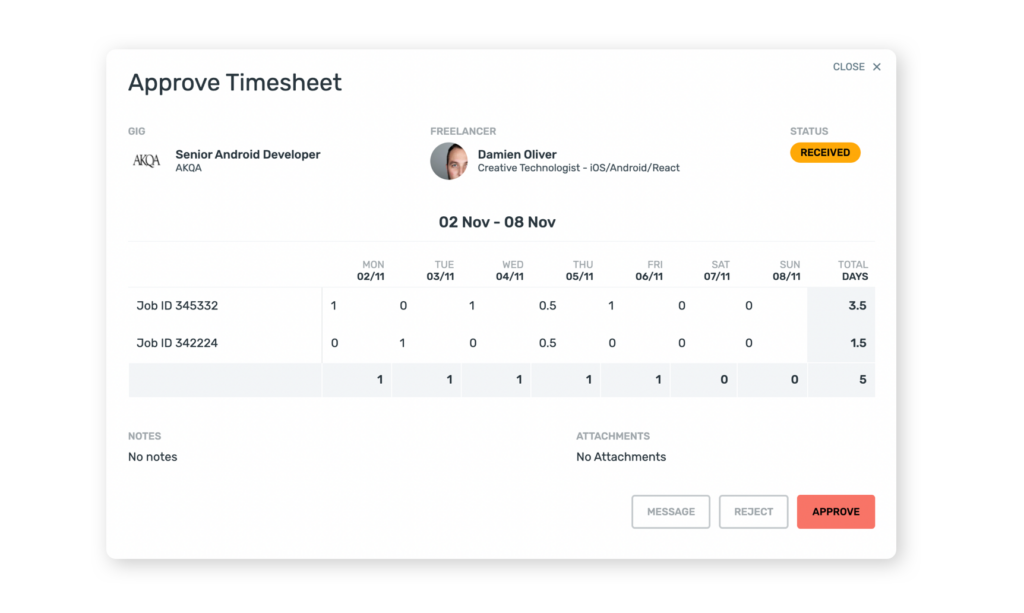

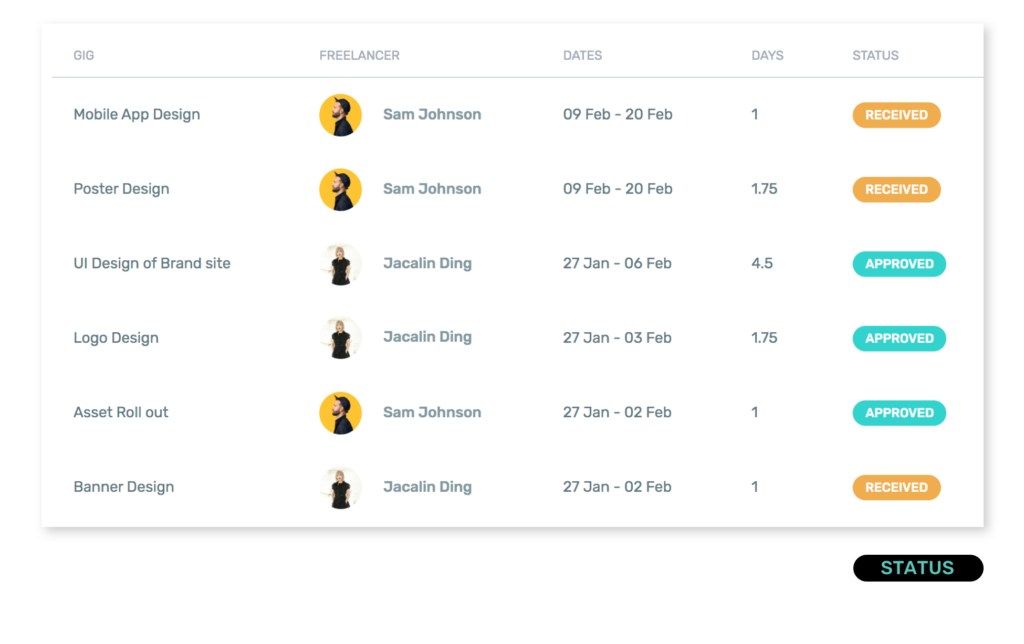

Seamlessly Integrated Simply Managed

In the Cavalry platform, Payroll seamlessly weaves into the entire experience. No fuss, no frills – just a smooth end-to-end journey backed by our dedicated Payroll team. Picture this: timesheets and approvals, project setup, invoices and history, messaging & video, notes, freelancer profiles, and job history – all effortlessly integrated into your talent system.

Got It

Now Tell Me more!

Talent Manager, DDB Group Sydney

“Cavalry is a well-designed, thoughtful and impressive product that offers an easy option for employers that need immediate freelance support. Cavalry’s support team is there to help you when you need, but the platform simply is a self-sustainable and low maintenance staffing provider. This is (or should be!) the future of recruitment agencies!”

Cavalry Connect

Get the weekly inside scoop on all things freelancing

I'm a hirer

I'm a freelancer